Can I Write Off My Property Taxes . how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023. Instead, you add the $1,375. State and local governments assess property taxes annually, based on the value of a property. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. Even if you itemize, the. however, you won't be able to deduct your property taxes if you're taking the standard deduction.

from blog.turbotax.intuit.com

Even if you itemize, the. how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. however, you won't be able to deduct your property taxes if you're taking the standard deduction. State and local governments assess property taxes annually, based on the value of a property. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. Instead, you add the $1,375. you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023.

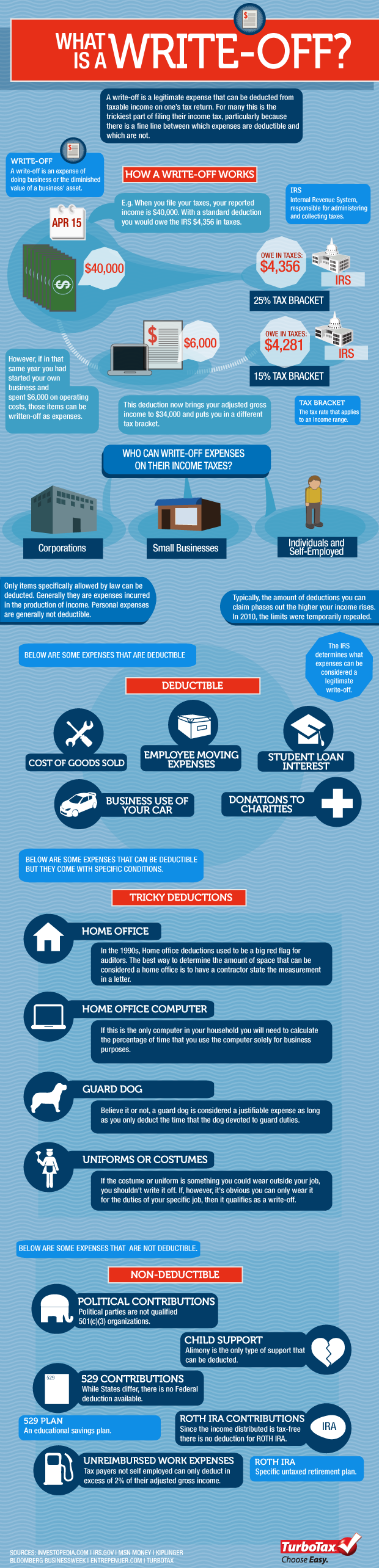

What is a Tax WriteOff? (Tax Deductions Explained) The TurboTax Blog

Can I Write Off My Property Taxes how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. State and local governments assess property taxes annually, based on the value of a property. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. however, you won't be able to deduct your property taxes if you're taking the standard deduction. the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023. Instead, you add the $1,375. Even if you itemize, the. how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year.

From www.pinterest.com

10 Tax WriteOffs for Real Estate Agents in 2021 Tax write offs, Real Can I Write Off My Property Taxes Even if you itemize, the. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. Instead, you add the $1,375. . Can I Write Off My Property Taxes.

From cemyfboc.blob.core.windows.net

Can My Laptop Be A Tax Write Off at Patricia Atkins blog Can I Write Off My Property Taxes the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. Instead, you add the $1,375. however, you won't be able to deduct your property taxes if you're taking the standard deduction. you can't deduct any of the taxes paid in 2023 because they relate to. Can I Write Off My Property Taxes.

From jerseystrife.blogspot.com

What Can I Write Off On My Taxes As Llc Business Owner Darrin Kenney Can I Write Off My Property Taxes the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. State and local governments assess property taxes annually, based on the value of a. Can I Write Off My Property Taxes.

From howtostartanllc.com

Tax Writeoffs for LLCs Maximize Deductions TRUiC Can I Write Off My Property Taxes the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. however, you won't be able to deduct your property taxes. Can I Write Off My Property Taxes.

From help.taxreliefcenter.org

How To Write Off Taxes On Rental Property Tax Relief Center Can I Write Off My Property Taxes you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. how to write off property taxes if you bought or sold a house. Can I Write Off My Property Taxes.

From www.youtube.com

Top 10 Tax Write Offs for Rental Property 2024 Deductions YouTube Can I Write Off My Property Taxes State and local governments assess property taxes annually, based on the value of a property. how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the. Can I Write Off My Property Taxes.

From printabledbnunez.z21.web.core.windows.net

Real Estate Tax Write Off Categories Can I Write Off My Property Taxes Instead, you add the $1,375. however, you won't be able to deduct your property taxes if you're taking the standard deduction. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. the total deduction allowed for all state and local taxes (for example, real property. Can I Write Off My Property Taxes.

From fabalabse.com

Can I write off home improvements on my taxes? Leia aqui How much of Can I Write Off My Property Taxes how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. State and local governments assess property taxes annually, based on the value of a property. the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes,. Can I Write Off My Property Taxes.

From cexrzvzm.blob.core.windows.net

Can You Write Off Property Taxes On A Second Home at Joseph Allen blog Can I Write Off My Property Taxes you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023. Even if you itemize, the. State and local governments assess property taxes annually, based on the value of a property. you may deduct as an itemized deduction, state and local income. Can I Write Off My Property Taxes.

From www.stoneoakmgmt.com

Tax Write Offs For Your Austin Rental Property Can I Write Off My Property Taxes how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. however, you won't be able to deduct your property taxes if you're taking the standard deduction. you may deduct as an itemized deduction, state and local income taxes withheld from your wages. Can I Write Off My Property Taxes.

From www.freshbooks.com

A Simple Guide to Small Business Write Offs Can I Write Off My Property Taxes the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. Even if you itemize, the. you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023. you may deduct. Can I Write Off My Property Taxes.

From morrisinvest.com

Is Rental Property a Tax WriteOff? Morris Invest Can I Write Off My Property Taxes Even if you itemize, the. Instead, you add the $1,375. how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. however, you won't be able to deduct your property taxes if you're taking the standard deduction. State and local governments assess property taxes. Can I Write Off My Property Taxes.

From www.pinterest.com

Is Rental Property a Tax WriteOff? Morris Invest in 2024 Rental Can I Write Off My Property Taxes State and local governments assess property taxes annually, based on the value of a property. Instead, you add the $1,375. Even if you itemize, the. however, you won't be able to deduct your property taxes if you're taking the standard deduction. the total deduction allowed for all state and local taxes (for example, real property taxes, personal property. Can I Write Off My Property Taxes.

From lyfeaccounting.com

14 of the Biggest Tax Write Offs for Small Businesses! Can I Write Off My Property Taxes you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023. Instead, you add the $1,375. Even if you itemize, the. how to write off property taxes if you bought or sold a house this year if you owned taxable property for. Can I Write Off My Property Taxes.

From www.hegwoodgroup.com

Property Tax WriteOffs to Take Advantage of in Dallas TX Can I Write Off My Property Taxes Even if you itemize, the. Instead, you add the $1,375. the total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or. you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until. Can I Write Off My Property Taxes.

From www.pinterest.ca

Tax Write Offs For Real Estate Agents Tax write offs, Real estate Can I Write Off My Property Taxes how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. you may deduct as an itemized deduction, state and local income taxes withheld from your wages during the year (as reported on. however, you won't be able to deduct your property taxes. Can I Write Off My Property Taxes.

From dxomtekwt.blob.core.windows.net

Can You Write Off Apartment Rent On Your Taxes at Christopher Torres blog Can I Write Off My Property Taxes you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023. Even if you itemize, the. however, you won't be able to deduct your property taxes if you're taking the standard deduction. how to write off property taxes if you bought. Can I Write Off My Property Taxes.

From blog.turbotax.intuit.com

What is a Tax WriteOff? (Tax Deductions Explained) The TurboTax Blog Can I Write Off My Property Taxes how to write off property taxes if you bought or sold a house this year if you owned taxable property for part of the year. you can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023. Instead, you add the $1,375. Even. Can I Write Off My Property Taxes.